Reach out to one of our Chevron Wealth Preservation specialists for more information.

Is It Time to Revisit the Annuity Option?

With inflation continuing to be more persistent than anticipated, it is likely that, at least for now, higher interest rates are here to stay. With the rapid rise in interest rates to date, annuity rates have reached levels not seen in over a decade.1 They are currently guaranteeing the highest payout rate that has been offered in decades.

In this current climate of declining defined benefit pensions, volatile financial markets and increasing longevity, the potential for stable income for life using an annuity may be a viable option.

What is a Life Annuity?

An annuity is a form of insurance that provides a stream of payments to an individual for life in exchange for a lump sum premium. For individuals who want a reliable flow of income or worry about outliving their assets, it provides the benefit of a stable income stream that is guaranteed until death.

In general, the best time to purchase an annuity is when interest rates are high and prospective inflation is low. This is because the amount of income paid to the holder is generally set at the time of purchase and based on prevailing interest rates. If an annuity is purchased in a period of lower interest rates, the payments will be less than if purchased when rates are higher. Since the annuity provides fixed payments, inflation will erode the purchasing power of future annuity payments.

While the fixed payments are guaranteed as long as the annuitant(s) is alive, the corresponding drawback is that the initial capital put into the annuity cannot be reclaimed as it has been exchanged for the ongoing stream of income. As such, the idea of locking up a substantial amount of retirement funds in an annuity may not be preferable for some due to the lack of liquidity. As well, annuities generally do not provide funds to be left within an estate after death, although an insured annuity strategy could be implemented if capital preservation is important.

Annuities are great for:

• Someone who is worried about outliving their income.

• Someone who likes guarantees

An Annuity to Maximize your Canadian Pension Plan Payments

Eligible recipients could opt to delay electing to withdraw their CPP benefits, thus maximizing the monthly payments received over their lifetime. A term certain annuity can help bridge that gap between ages 60-70 and help make that possible.

An Annuity as Part of a Balanced Portfolio

Generally, a life annuity acts like an illiquid, permanent type of fixed-income instrument. It is considered “permanent” because, unlike traditional bonds which fall in price when interest rates rise, the income generated by an annuity remains unaffected by changing rates. Many investors hold fixed-income investments to provide income and stability against stock market declines and an annuity can play a similar complementary role within a portfolio. Some investors choose to put a smaller proportion of savings into an annuity and increase the amount over time as a way of mitigating potential future rate increases.

Estate Planning with an Insured Annuity

An insured annuity provides the guaranteed stream of income of an annuity while maintaining capital available for transfer to the next generation. It consists of the purchase of a permanent life insurance policy and a life annuity, with the insurance policy death benefit equal to the amount of the annuity investment. This replaces the capital used to purchase the annuity in the estate for the benefit of heirs. The premiums for the life insurance policy can be funded by a portion of the annuity payments received, and insurance proceeds are paid to named beneficiaries. Since a portion of the payment is considered to be a return of principal, only the interest-income portion of the payment is subject to tax annually. When non-registered funds are used, the preferential tax treatment can be significant.

Seek Assistance

With rising rates, annuities may once again become a viable retirement strategy for investors. For more information on the potential opportunity, please reach out to your Echelon advisor. 1.

https://www.cannex.com/index.php/services/canada/annuity-products/income-annuities/

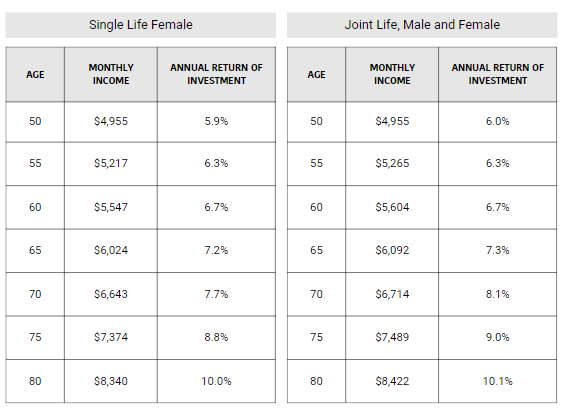

Here’s an idea how this set it and forget it strategy looks based on: Various ages listed below are when the annuity is purchased.

- A $1,000,000 RRSP investment

- Guaranteed income until the day they die, there would also be a 10-year guarantee period where if they die in the first ten years the beneficiary would receive the income to the end of 10 years.

- Note that the joint life scenario would reduce income to 60% upon first death

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC. Chevron Wealth Preservation offers products sold through members of Assuris designated by OSFI.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.