Reach out to one of our Chevron Wealth Preservation specialists for more information.

For Someone Who Likes Guarantees

There has been an increase in activity in the annuity space since the summer of 2022.

As you could have guessed they are more attractive now than they had been in the past decade.

Annuities are great for:

- People who are worried about outliving their income

- People who like guarantees

- A way to diversify a portfolio, a substitute for fixed income

- People who are fee sensitive or are not quite sure if what type of investment to utilize

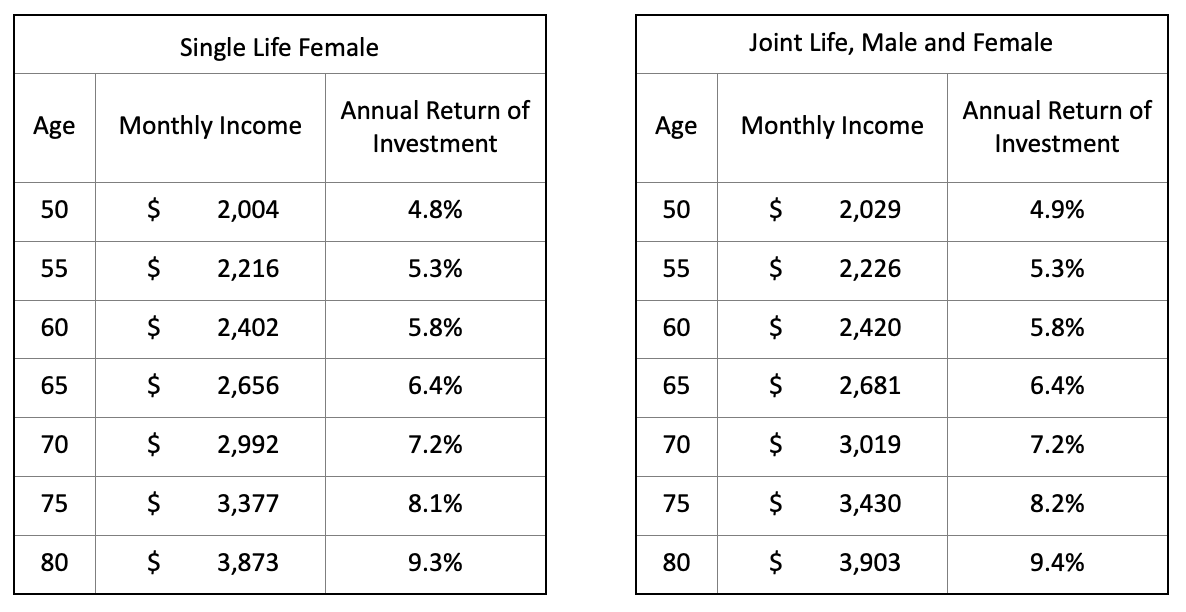

Here’s an idea how this set it and forget it strategy looks based on:

- Various ages listed below are when the annuity is purchased

- A $500,000 RRSP investment

- Guaranteed income until the day they die, there would also be a 10-year guarantee period where if they die in the first ten years the beneficiary would receive the income to the end of 10 years

- Note that the joint life scenario would reduce income to 60% upon first death

Note that once this strategy is implemented there is no monitoring necessary, and that income is Guaranteed.

Another strategy is “back-to-back annuities” where an annuity and permanent life insurance policy are purchased at the same time. The initial annuity investment is in the same amount as the insurance death benefit. The annuity income pays the life insurance premium and there will be additional money left over (the spread) for the client to enjoy during their lifetime. When they pass the insurance benefit replaces the annuity investment.

If you would like to learn more about annuities or help deciding if this strategy is right for you, contact your Echelon advisor today.

Insurance products and services are offered by life insurance licensed advisors through Chevron Wealth Preservation Inc., a wholly owned subsidiary of Echelon Wealth Partners Inc. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of life insurance products or securities mentioned herein. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. Please note that only Echelon Wealth Partners is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation is not.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.